The U.S. consumer, responsible for over two-thirds of the country’s GDP, has shown a continued willingness to spend in spite of the highest inflation since 1980. Official unemployment is low, but so are personal savings in the past year. Credit card debt is near the highest levels it’s ever been.

What does the general outlook of the U.S. consumer say about the larger economic picture?

Key Takeaways:

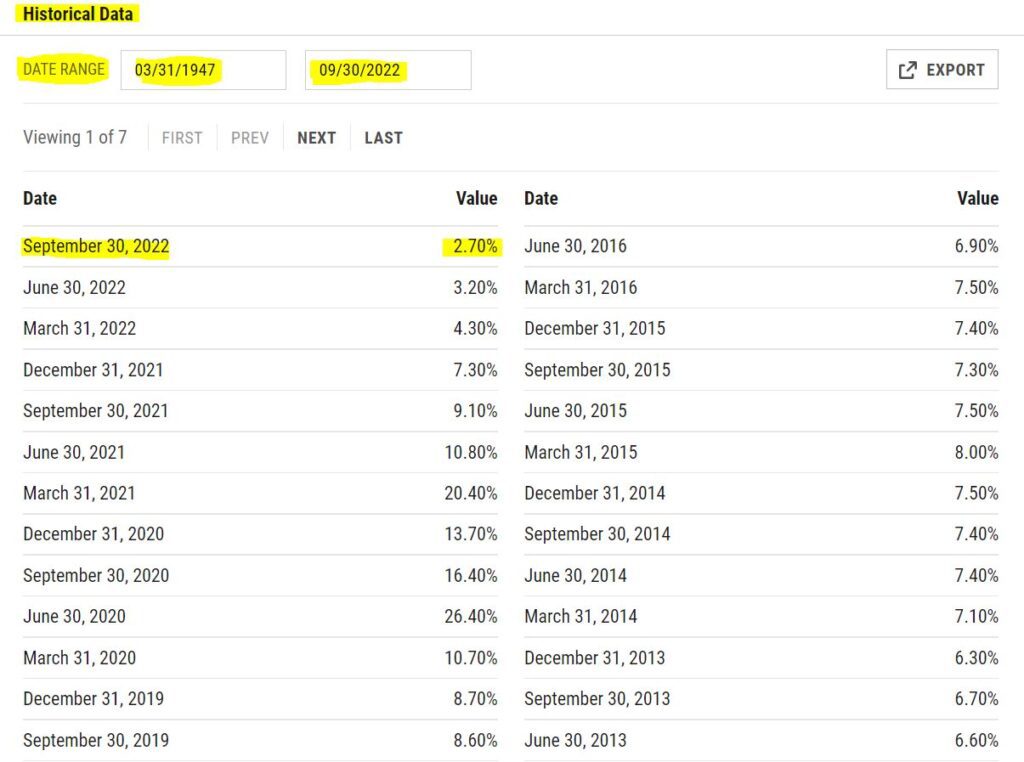

- The U.S. personal savings rate is at 2.7%, near all-time historic lows

- Most Americans anticipate rising costs of living, goods, and services in 2023 and beyond

- Credit card debt is near record highs, showing that a nominal raise in incomes has not created bottom-line savings, offset by inflation

According to Morgan Stanley, corporate sales volumes, pricing power, and profits are likely to decline in 2023, resulting in weak GDP growth. This is due to the fact that the timing and severity of the economic slowdown will probably be determined by consumer spending, which accounts for two-thirds of U.S. economic activity.

It may also affect when interest rates are cut, which historically has been a more reliable indicator of the end of a bear market.

Is the U.S. Consumer in Good Shape?

2022 was a wild ride for the world. After two years of abject fear and crisis, record inflation and very little leadership for the direction of the world, things suddenly opened back up. The demand for medical and mask mandates loosened a little, and people went back to work.

A war started. The price of gas went sky-high. Some people voted. No one seems to know if voting matters any more.

2023 looks like it will see the fallout of recent economic history before rebounding, if you’re cautiously optimistic like many U.S. consumers are said to be. They’re not expecting a miracle, but they’re less afraid than a year ago.

And hopefully, that will spell good things for the small business owner and Main Street.

U.S. Retail Sales

US Retail Sales tracks all transactions in the US economy that are not related to food servicesand are a farily reliable indicator of the health of the economy. Additionally, they can provide insight into how consumers spend their discretionary income.

US retail sales fell by 14.10% in 2009, the year of the financial crisis. Releases of retail sales data, in particular, can have a significant impact on the markets and sectors that are driven by consumers.

U.S. Personal Savings Rate

The personal savings rate in the United States is 2.70%, down from 3.20% previous quarter and 9.10% last year. This figure is less than the long-term average of 8.77%.

As you can see, the savings rate dramatically fell off after the stimulus and economic recovery payments stopped. Can the U.S. consumer trudge on, unsubsidized? Or does this spell the end to the myth of the consumption-based economy?

U.S. Consumer Confidence

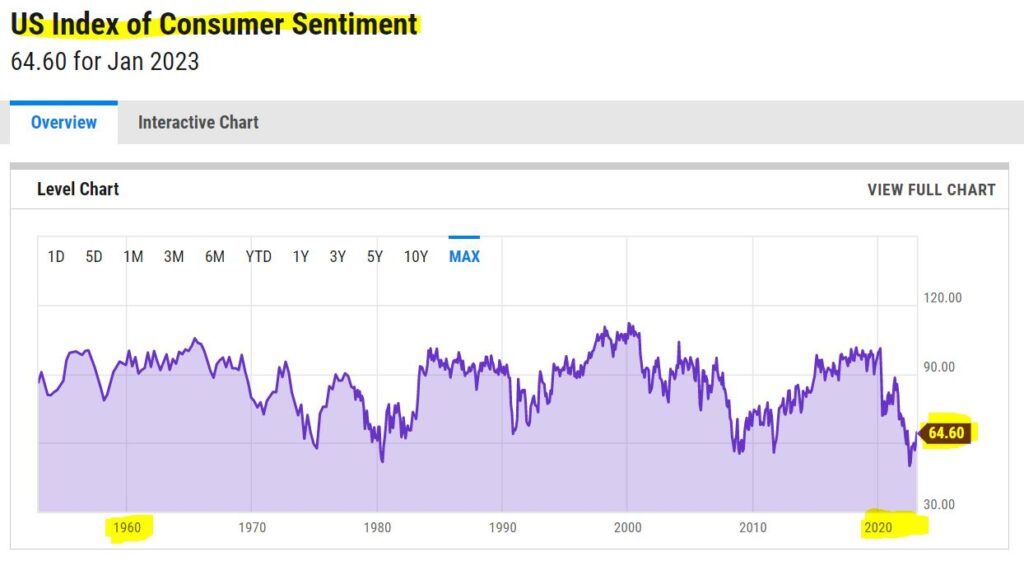

The University of Michigan’s US Index of Consumer Sentiment (ICS) analyzes consumer sentiment in the United States based on surveys of random samples of US homes. The index assists in gauging consumer mood on, among other things, company conditions and personal finances.

In the past, the indicator has shown decreased consumer confidence during recessions and increasing consumer confidence during expansions. The U.S. hit record-low consumer confidence at the midpoint of 2022.

U.S. Consumer Debt

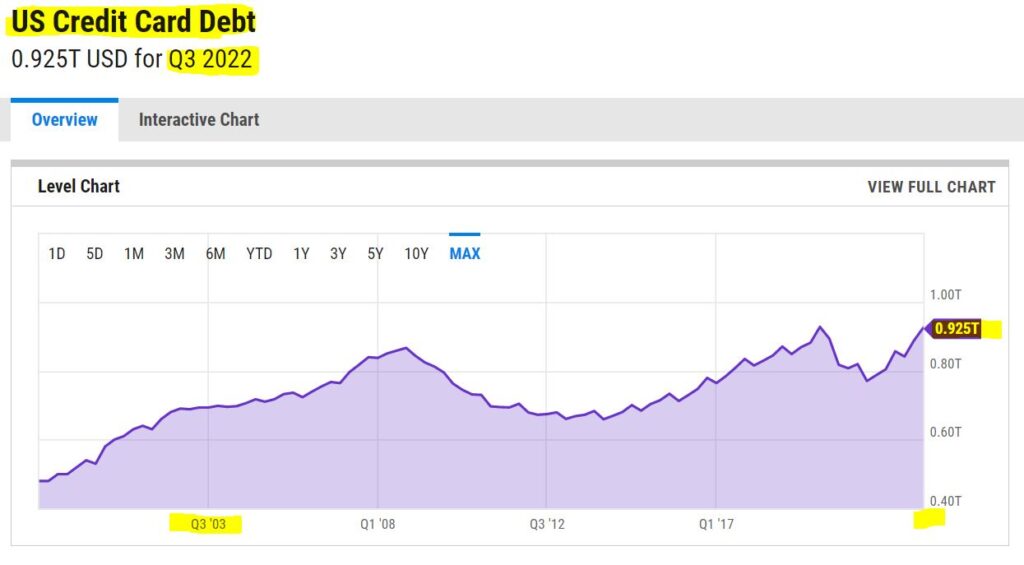

The U.S. neared its all-time record highs for outstanding credit card debt which occurred in Q4 2019, just before the shutdown of the global economy.

The amount of revolving credit card debt has more than doubled in just the last 20 years.

U.S. Consumer Price Index

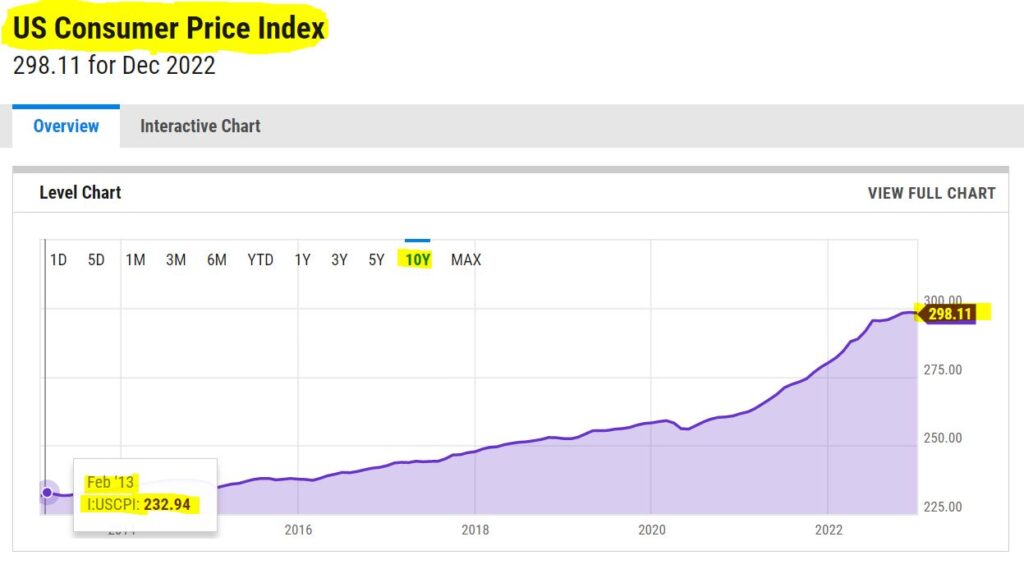

The Bureau of Labor Statistics’ Consumer Price Index (CPI) measures price changes in a range of items and services purchased by U.S. households. The year over year change in the CPI is the most commonly used method for determining the rate of inflation. It is published monthly and is also known as the cost-of-living index.

Official word is that inflation is cooling. However, by the looks of things, my guess is it’s only pausing because the prices are leveling out, not going down longterm. There are a lot of economic fundamentals rearing their heads which can’t be papered over. And that’s what got us here.

U.S. Housing

The U.S. Housing Affordability Index is down 50% over the last decade.

Additionally, you can see that people have been buying fewer homes lately, but the price of houses has not come down very much, likely because inflation is showing the true value of real assets in spite of touted purchasing power.

U.S. Business

Because most U.S. businesses make the majority of their money from U.S. markets, the relationship between the general state of the consumer and business can’t be denied as a reflection of the bigger economic picture.

U.S. Manufacturing

U.S. manufacturing sales hit all-time record highs at the end of 2022/beginning of 2023.

U.S. Unemployment

The US Unemployment Rate calculates the proportion of all employees in the country who are in the labor force but are unemployed. It is one of the metrics that is most closely watched to gauge how well the US labor market and economy are doing.

In the past, the US unemployment rate peaked at 10.80% in 1982 and dropped to 9.9% in November 2009. These were two periods of notable recession.

The Job Openings and Labor Turnover Survey shows a decrease in the number of new job listings. The most recent monthly data available showed 10.3 million vacancies in October, a 760,000 decrease from the previous year.

U.S. Stock Market

The U.S. stock market has been a bellwether for the world economy and general state of commerce across the globe and at home.

Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, is a stock market index that represents the value of 30 large, publicly traded companies based in the United States, as well as how they have traded in the stock market over time. These 30 companies are also part of the S&P 500 Index.

NYSE

The NYSE Composite is an index of the stock market that includes every common stock listed on the NYSE, including American depositary receipts, real estate investment trusts, tracking stocks, and international listings. Each of the ten industries included in the Industry Classification Benchmark are represented by companies in this group.

Nasdaq

Nasdaq, founded in 1971, is best known for its equity exchange, but also sells data to Wall Street investors and fund managers as part of its busines model.

This Year’s Biggest Winners and Losers by Company

Some companies have done better than others, but some outcomes have surprised many. Perhaps the last couple of years of people staying home and inside have been the death knell for businesses that saw a temporary spike due to logistical circumstance.

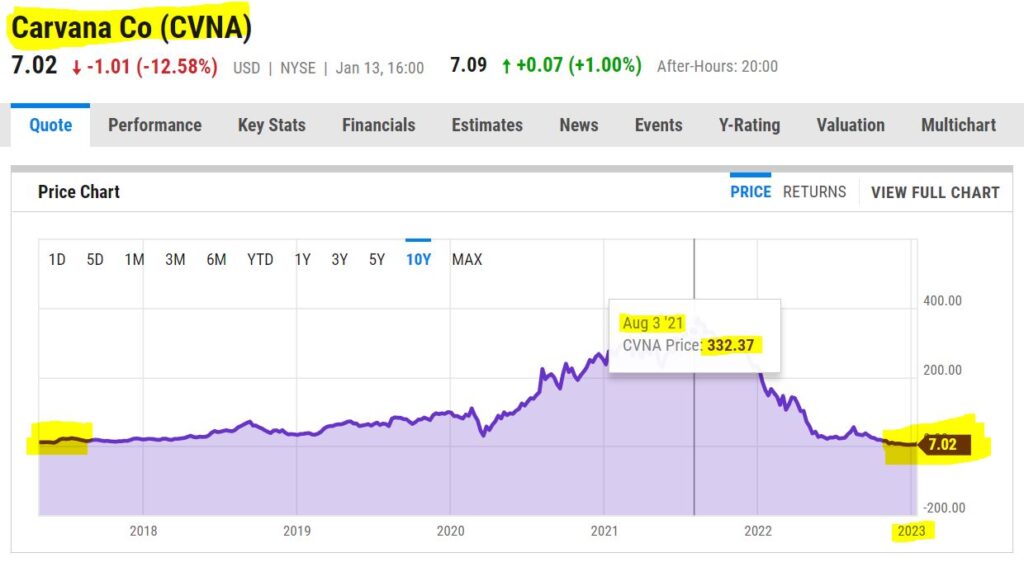

CVNA – Carvana

Carvana Co is an online marketplace for buying and selling used vehicles. Revenue is generated by used vehicle sales, wholesale vehicle sales, and other sales and revenues. Other sales and earnings include loans initiated and sold in securitization payments or to financing partner organizations, VSC commissions, and GAP waiver coverage sales.

SHOP – Shopify

Shopify primarily provides small and midsize businesses with an e-commerce platform. Subscription solutions (43% of the company’s fiscal 2018 revenue) and merchant solutions (57% of the company’s fiscal 2018 revenue) are its two business segments.

V – VISA Visa Inc.

The biggest payment processor in the world is Visa. It processed a total volume of over $14 trillion in fiscal 2021. Visa conducts business in more than 200 nations and supports more than 160 different currencies. Over 65,000 transactions can be handled by its systems each second.

No one should be surprised to see their stock doing record numbers, considering the enormous amount of credit card debt held by consumers.

JPM – JPMorgan Chase and Co.

With nearly $4 trillion in assets, JPMorgan Chase is one of the biggest and most intricate financial institutions in the United States. Consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management make up its four main divisions.

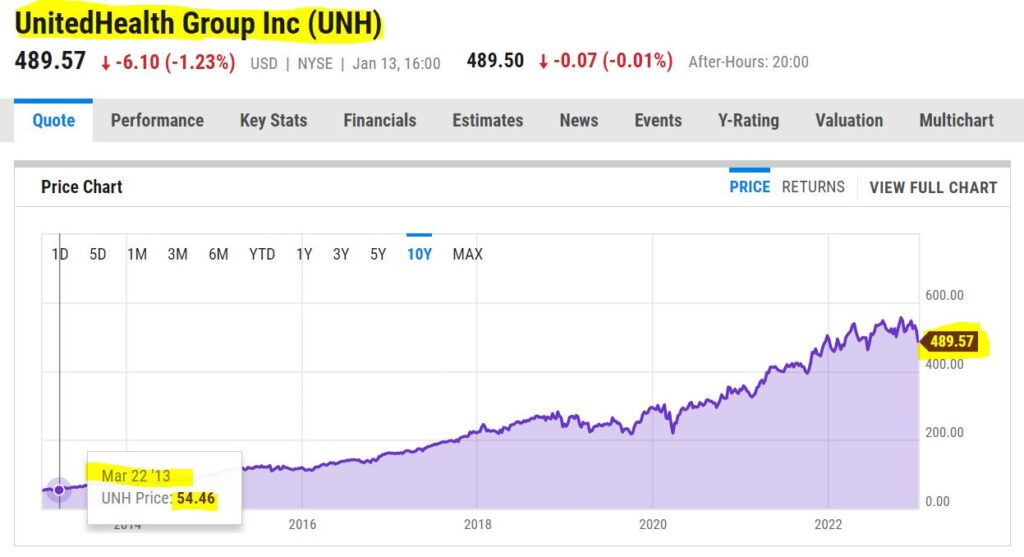

UNH – UnitedHealth Group Inc.

One of the biggest private health insurers, UnitedHealth Group, will provide medical coverage to 50 million members worldwide by the end of 2021, including 5 million from countries other than the United States. Leading the way in government-backed, self-directed, and employer-sponsored insurance plans, UnitedHealth has amassed enormous scale in managed care.

United Health Group has also reported record profits from its healthcare insurance coverage, even at a time when fewer people visited hospitals and doctors’ offices for care.

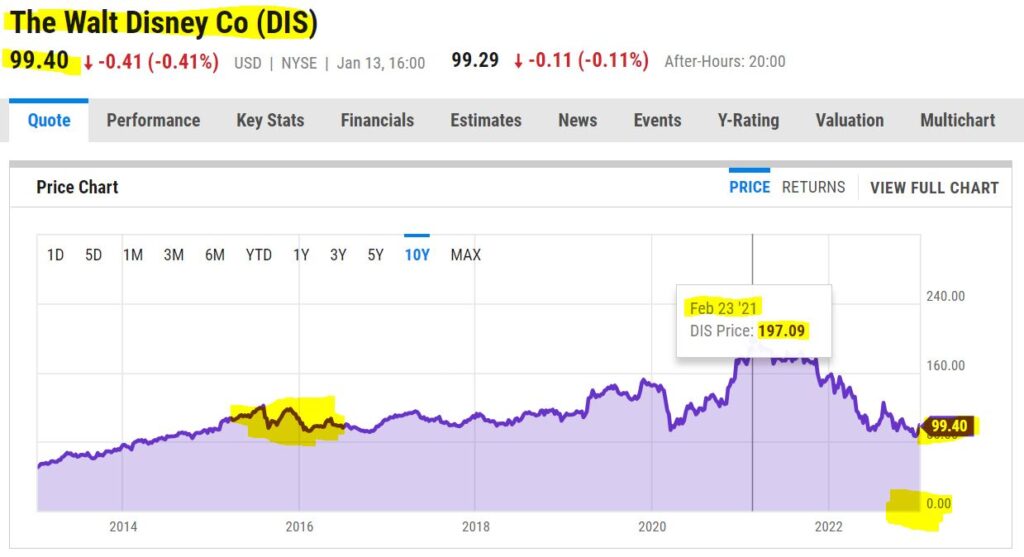

DIS – Disney

Disney owns and operates a number of media networks, including ESPN, as well as live-action and animated film studios like Pixar, Marvel, and Lucasfilm. By purchasing the remaining shares of Hulu and launching Disney+ and ESPN+, Disney transformed into a company that focuses more on streaming.

BitCoin Price Moves

Cryptocurrency’s total market cap neared $1 Trillion USD as Bitcoin added nearly 30% in gains in just one week.

Will it hold, and is this the start of a new bull market? Or is it just another interim pump and dump by Bitcoin whales, whose large holdings make even moderate price moves highly profitable when they buy quickly, and sell even faster?

Conclusion: How the U.S. Consumer is Doing

The U.S. consumer, held back by inflation, debt, and lack of affordable housing, continues to spend at record rates, as shown by total retail sales and manufacturing orders.

JPMorgan Chase, however, is predicting a recession in 2023.

Without fundamental change to the monetary and banking systems, the economy will likely remain a combination of real market forces like supply and demand, as well as artificial ones like financial packages to extend the current economic model’s life, if just a little longer.

Frequently Asked Questions – State of the U.S. Consumer

A record number of Americans now spend more than 30% of their income on rent, which is the highest it has ever been since the figure was recorded, up from 23% in the 1990’s. Experts don’t even recommend budgeting that much of your income for housing. Housing affordability continues to be a problem along with high inflation, causing quality of life disruptions in the U.S. and around the world.

With a high rate of auto loan defaults, the lowest score on the housing affordability index since 1989, and record revolving credit card debt, the U.S. consumer looks beaten down as any gains in personal income have failed to keep up with inflation.

Almost 75% of the U.S. is living paycheck to paycheck, and lack $400 in savings for an unexpected expense. The savings rate is currently at a historically low 2.4%.

- A Better Way to Invest in Crypto: Intermediate Strategies that Remove All the Emotion and Stress - November 1, 2024

- America’s Payday Loan and Same-Day Paycheck Practices Hint at a Darker Norm - October 5, 2024

- America’s Food Processing Woes Continue With Listeria Outbreak, Lead, Arsenic, and Plastic Contamination - September 23, 2024

Pingback: Challenges and Problems Facing Small Businesses in 2023 - Upwardpreneur