FTC Disclosure: We may receive compensation if a site visitor clicks on links and makes a purchase. However, we provide an objective review, and we don’t always recommend everything we review.

Small business owners can spend up to 10 hours a month processing payroll. That works out to 1.25 wasted days a month you could have been doing something else that has a higher impact on your business and profits. Almost two-thirds of all business owners would prefer to outsource payroll entirely if they could.

Key Takeaways:

- Gusto.com is an automated time tracking and payroll software solution that calculates and files your taxes in all 50 states for you

- A 2022 TechValidate survey of 450+ Gusto customers showed they saved 5 hours per month after changing their time tracking and payments over to Gusto

- Gusto offers an automated solution to the one-employee business, i.e. the individually owned LLC or S Corp whose payroll treats you as a salaried employee for tax strategy and legal purposes

While you might believe that the only task involved in processing payroll is figuring out an employee’s pay, there are a few more important steps involved.

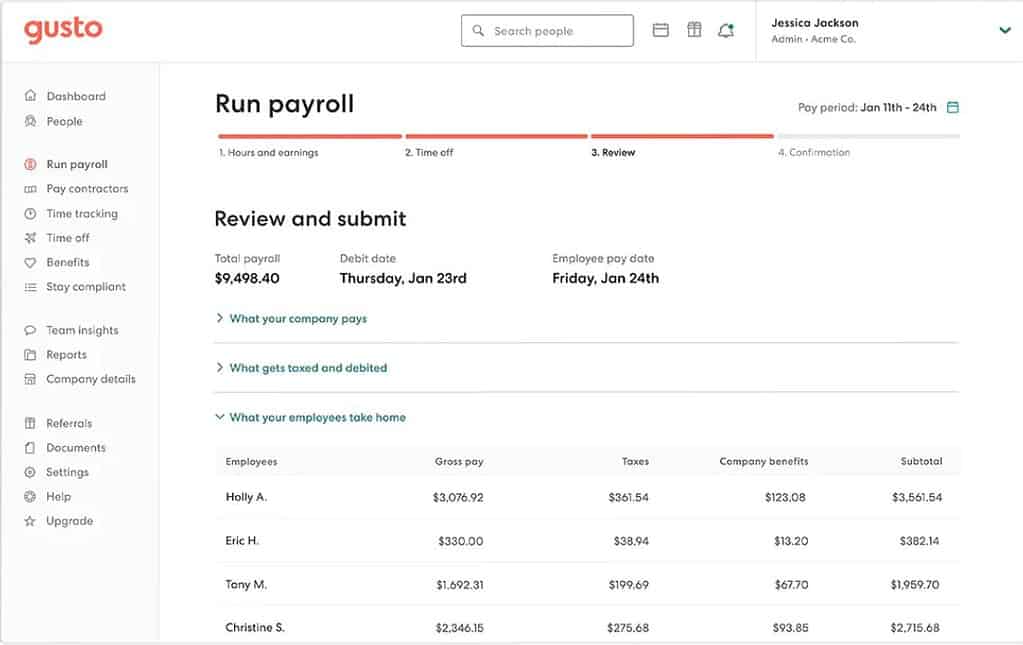

The worker’s gross pay must be determined before you can process payroll. Deductions and exemptions from their earnings for things like federal, state, and local taxes, Social Security, and benefit contributions must be subtracted from that sum. But that’s not where your accountability for handling payroll ends. You must also submit Form 941 to the IRS every quarter detailing the amount of money you withheld from each employee’s pay.

Fortunately, we live in an age where these things can be automated with software. Gusto payroll is an app and website that allows you to track your employees’ time, documents, and files all the necessary forms for you according to your state.

Automated Payroll, Payments and Time Tracking Software with Gusto

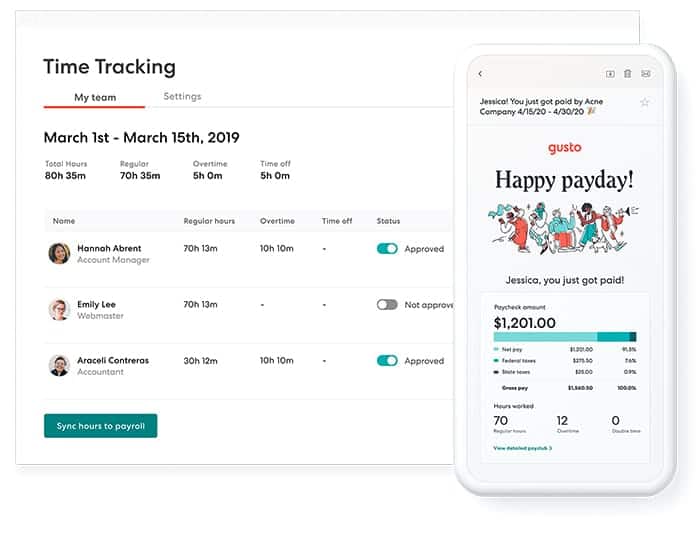

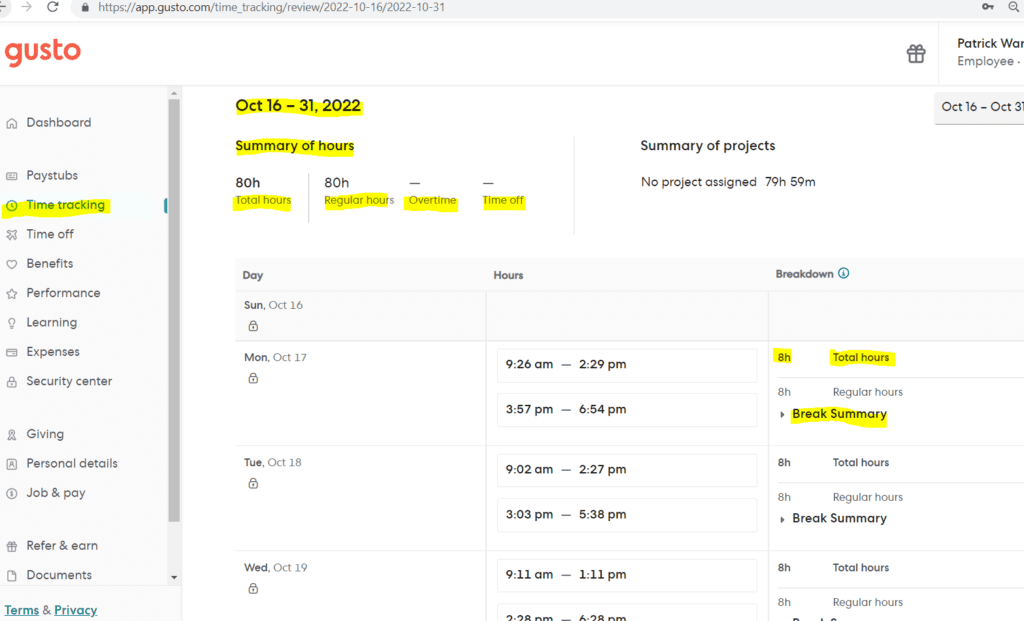

Gusto.com is a website and app that enables a business’s employees to clock in and out at work, request time off, track paid time off, and stay informed about deadlines for benefits and finalizing their time tracking each pay period. It automates most of the aspects of payroll and compliance for business owners and their accountants.

How Gusto Payments Works

There are specific records that you must maintain when processing payroll. For instance, the IRS mandates that you keep all employment tax records, including copies of employees’ Form W-4s and the dates and sums of your tax deposits, for a minimum of four years. Additionally, the Fair Labor Standards Act mandates that you keep payroll records for a period of three years to demonstrate that you are abiding by its minimum wage and overtime rules.

The interface is clean and minimized to keep the basics simple and easy. Cross-device functionality makes it handy for clocking in and out on your phone when you’re on the go or if you’re at your desk on your desktop PC at the office.

Gusto time tracking and payroll for new businesses takes care of all this for you.

Benefits of Gusto for Your Business

There are some serious benefits that you can see right away from Gusto:

- Easy clock in and out for all your staff – Now your employees can simply log into Gusto and clock in and out, making it the perfect employee timeclock software.

- Automatically files your payroll taxes – Also keeps up with changes in various laws and pays/deducts/tracks appropriately across different states for employees in different locations for your business

- Highly rated customer service – Dedicated support staff on call for Plus and Premium packages

- Employee benefits and time tracking are built-in – Also helps you onboard new employees and communicate important news and deadlines regarding insurance, benefits and pay dates. Provides paid time off (PTO) accrual and access to savings plans, retirement savings account and 401k

- Unlimited payroll – The ability to issue payments as many times as you need per month and next-day direct deposit, integrates with Quickbooks and others

- Find tax credits for you – Based on your business activities like research and development, employee retention and hiring, you could save $250,000 by using R&D tax credits to counter payroll tax liabilities

With the ability to automate the necessary paperwork and compliance for the overwhelming majority of U.S. businesses, the one-employee business, Gusto really shines with even more flexibility.

But it’s what they have going on with their development and advanced coding side that really instills confidence in what to expect in the future. After all, you’re not going to want to decide on one automated processor and then have to go through another switch in just 5 or 10 years all over again.

Gusto shines for its primary role as an automated payroll, payments and employee time tracking software system.

Gusto Payroll Software Cost Per Month and Fees

Gusto pricing offers varying levels of access and benefits:

- Simple: costs $40/month and $6/payee for basic payroll,payments and automatic tax compliance

- Plus: $80/month and $12/payee, includes time tracking, PTO requests, custom onboarding documents, and dedicated Gusto customer service

- Premium: everything included in the Plus plan and more, but you must call Gusto to arrange this and to get their price, as they don’t make it public

Gusto Integration with Other Software and Apps

Gusto integrates with several different software programs, including Google Workspace, Freshbooks, HubSpot, Microsoft 365, Quickbooks Online, Monday.com, and hundreds more.

For instance, Connecteam is one of the most convenient and effective ways for deskless employees to track their work hours spent on jobs, clients, and projects from any device, at any time. Managers and business owners can integrate Connecteam with Gusto to ensure that their staff clock in on time and from the correct place, while their visual timesheets make payroll quick, accurate, and painless, allowing you to save time and focus on expanding your business.

Gusto Embedded Payroll API Advanced Compliance Features

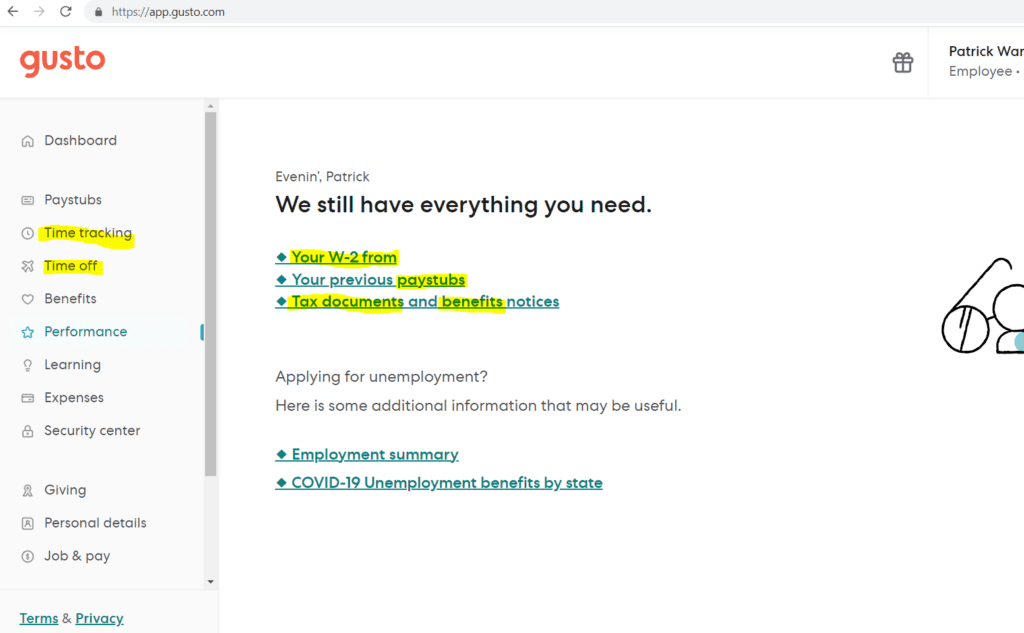

Gusto also produces your W-2s and 1099s at the end of the year and sends them electronically to your employees. For businesses that have to file taxes in a number of states, Gusto is a fantastic option. Not all payroll software can claim that multistate filings are included with all their plans.

API and Intake for Employees’ Prior Payroll History

Gusto embedded payroll API and prebuilt flow enables customers to quickly enter prior payroll data to make switching payroll providers simple at any time of the year. This greatly enhances user experience and guarantees accuracy of year-to-date taxes and filings.

API & Flow for Contractor Onboarding & Payments

Payments to contractors are handled very differently than their W2 counterparts because of their different tax treatment. We recently released a new API & Flow to make it simpler to set up and pay 1099 workers in order to enhance the contractor onboarding and payment experience.

Improved API and State Tax Setup Flow

Gusto introduced a new State Tax Setup prebuilt Flow and an updated API to give customers the precise state tax requirements for each employee due to the thousands of various tax scenarios by state.

To keep everyone compliant, employee tax needs are automatically updated when tax laws change.

Gusto Wallet App for Employees Ratings

The Gusto Wallet app is available for payment notifications and looking at individual pay stub documents. It’s relatively straight-forward and easy to use.

Gusto wallet has a 4.1/5 rating on Google Play and 4.8/5 on the Apple App Store.

However, you cannot track time on the wallet app. To track time via mobile on Gusto.com, load your favorite mobile browser and type in Gusto.com. It still works fine but you might have to zoom in with your fingers.

Gusto Pros and Cons

Gusto.com is hailed around the web for its basic function. Here are some advantages of using Gusto.com:

Gusto Pros

- Basic time clock for clocking in and out is simple, effective, and reliable

- Effective payroll integrations with lots of other time tracking and bookkeeping software

- Automatically files administrative requirements and all taxes on your behalf

Gusto Cons

- One reviewer reported that administrative mistakes with Gusto left the entire workforce with a lapse in healthcare coverage for several months

- Many clients of Gusto said that their customer service is not very helpful for more complex and sophisticated issues that arise, like conflicts within the program that result from rare exceptions with state procedure

- Gusto may not be ideal for businesses once they surpass the 150-employee mark

Conclusion: Gusto Payroll Reviews

Most people who use automated payroll, payments and time tracking software report greater peace of mind, more free time and saving money by maximizing deductions. At the end of the day, it really all depends on your needs.

Gusto.com offers a highly reliable, predictable system for businesses out there at an affordable price. However, they’re not without their share of problems and complaints, and it sounds like their customer service is not firing on all cylinders.

With over 200,000 businesses using its services, they seem like a safe bet. However, no company is perfect and some business owners have had issues with their customer servics, attempting to fix errors regarding administrative processes, as seen on the BBB website.

Frequently Asked Questions – Gusto.com

Gusto is a reliable payroll tool that enables you to automate simple to complex payroll processes for both employees and independent contractors. It streamlines the process of onboarding new employees and reduces manual errors. It’s the tool you want in your corner because of its user-friendly approach to payroll management, which will help to ensure that your payroll workflow goes without a hitch.![]()

Gusto offers payroll pricing in three tiers: simple, plus and premium. The price ranges from $40/month and $6 per employee to $80/month and $12 per employee for more advanced features like PTO tracking and custom onboarding documents.

Be sure to comply with ACA requirements if you want to offer health insurance to your team. If you have benefits managed by Gusto, they’ll manage your pre-tax payroll deductions, provide a 1095-C to applicable companies, give your newly hired employees the ACA Marketplace Notice, store the section 125 document in your account, and keep you in line with your current policies and insurance provider to keep you in compliance with ACA regulations.

Gusto tracks time for employees who log in and clock in and out through the Gusto dashboard, then syncs hours with payroll automatically.